We are committed to helping global investors achieve excellent return on investment through advanced quantitative trading technology and in-depth data analysis. DDI provides a range of customized services to meet the different needs of its customers and ensure a competitive advantage in a complex market environment.

DDI provides a complete set of data-driven services designed to achieve stable and sustainable wealth growth through intelligent investment strategies and strict risk management. Our services cover the global market and ensuring that your assets perform optimally in any market condition.

DDI provides a complete set of data-driven services designed to achieve stable and sustainable wealth growth through intelligent investment strategies and strict risk management.To achieve the most optimal performance.

Our services cover major financial markets around the world, including North America, Europe, the Asia-Pacific region and so on. DDI's global vision and localization strategy ensure that your portfolio has diversified and robust growth globally.

Our services cover major financial markets around the world, including North America, Europe, the Asia-Pacific region and so on.Ensure that your portfolio enables diversified and robust growth globally.

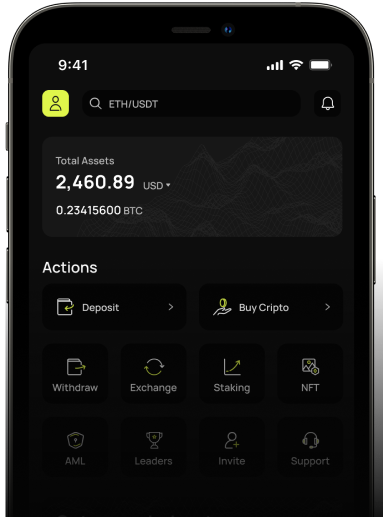

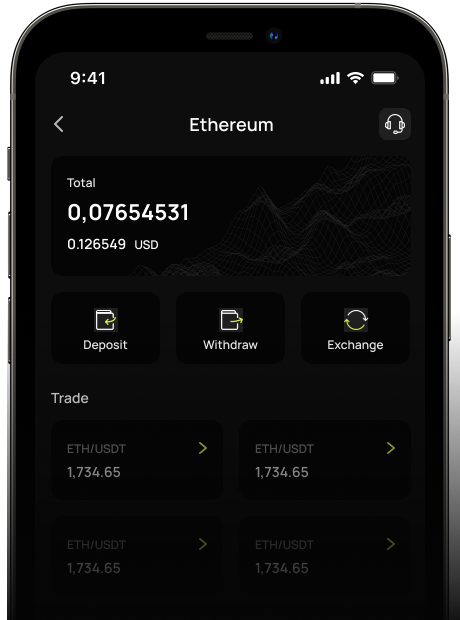

DDI promises to provide the highest standards of transparency and security for each customer. Our system uses bank-level encryption technology, and all transactions and data can be monitored in real time, to ensure the absolute security of your funds and personal information.

DDI provides customized asset management services based on each customer's financial goals and risk preferences. We design your best investment portfolio through accurate data analysis and thorough market research to ensure solid growth of your assets in the long term.

We continue to invest in cutting-edge technologies to drive innovation in quantitative trading. DDI's technology research and development team focuses on developing more advanced algorithms and trading models

At DDI, we leverage advanced artificial intelligence and machine learning technologies to provide you with deep market insight. Our system can not only quickly analyze huge amounts of data, but also predict market trends to target potential investment opportunities in advance.

Each investor has a unique financial background and goals. DDI's flexible and dynamic wealth management strategy to ensure that your portfolio is always aligned with market changes, helping you achieve sustained growth in a variety of market conditions.

DDI puts your asset security first. We use the most rigorous encryption technology and leading global security standards to ensure that your funding is fully protected in any situation. Real-time monitoring and transparent operation to make you feel at ease, at any time to control your financial trends.

DDI uses a dynamic asset allocation model to flexibly adjust the investment portfolio according to the changes in the market environment and the economic cycle to ensure that the optimal investment opportunities can be captured in different market stages.

Through the cross-market arbitrage strategy, DDI can quickly detect price differences between different financial markets around the world, realize risk-free arbitrage, and create stable additional returns for customers.

To reduce investment risk, DDI uses a highly decentralized investment strategy that invests in multiple asset classes and regional markets to ensure robust portfolio performance in any single market volatility.

DDI is committed to providing customers with the most advanced and secure quantitative trading solutions. We deeply combine technological innovation with financial markets to ensure that every customer can achieve the best return on investment in the global market.

By continuously optimizing our systems and services, we remain committed to excellence to help you achieve financial freedom in complex markets. No matter how the market changes, DDI is always your most reliable investment partner.

DDI is the world’s leading quantitative trading platform, providing investors with robust returns and comprehensive risk management through advanced data analysis and intelligent algorithms.

Copyright © 2025 Data-Driven Investing